Why The insurance Cares About Your HVAC System

Why Insurance Cares About Your HVAC System

The core of your home’s comfort system lies within the HVAC unit, a pivotal component not just for maintaining a pleasant living environment but also for ensuring your home’s insurance viability. Understanding why insurance companies give so much importance to your HVAC system can shed light on unforeseen rejections. This blog dives into the critical aspects of HVAC systems that influence insurance considerations, touching on one of the crucial topics found in the 4-Point Inspection.

The Preference for Heat Pump Central Air

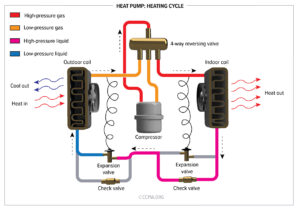

The most ubiquitous HVAC technology is the heat pump central air system, renowned for its efficiency and safety. Unlike traditional heating methods that generate heat, heat pumps transfer heat, making them more energy-efficient and environmentally friendly. This efficiency not only reduces your carbon footprint but also translates into lower energy bills. From an insurance perspective, the reduced risk of fire and carbon monoxide poisoning inherent in these systems can lead to more favorable insurance premiums. Implementing such systems could be a strategic move for homeowners looking to optimize their insurance costs, particularly in regions with specific requirements within Florida.

The Importance of Your Primary Heat Sources

The choice of your home’s primary heat source, whether it’s a wood-burning stove, gas fireplace, or central heating system, plays a significant role in insurance evaluations. Insurance companies scrutinize these sources due to the varying levels of risk they present, from fire hazards to carbon monoxide emissions. Opting for safer, more efficient heating options can not only enhance your home’s safety but also positively impact your insurance premiums. It underscores the value of conducting regular home insurance inspections, including the 4-point inspection, to ensure your heating sources meet your insurance provider’s standards.

Identifying Signs of Water Damage

Water damage, a common consequence of HVAC system malfunctions, can lead to significant insurance claims. Recognizing signs of water damage early—such as unexplained moisture or water stains—can prevent extensive damage and insurance headaches. Regular home inspection services can identify potential risks, ensuring your HVAC system remains in top condition and mitigating the risk of insurance claims. Most often these come from the drain pan or drain line being damaged or clogged.

The Age of Your HVAC System and Insurance Considerations

Insurance companies are wary of HVAC units over 20 years old, given their increased likelihood of failure and inefficiency. Aging systems are more prone to issues that can lead to insurance claims, from water damage due to leaks to fire hazards. Upgrading your HVAC system not only enhances your home’s safety and efficiency but can also lead to lower insurance rates.

Conclusion

The intricacies of your HVAC system play a substantial role in your home’s insurance considerations, affecting everything from premiums to policy approvals. Whether it’s through upgrading to a heat pump central air system or regularly maintaining your unit to prevent water damage, these measures can lead to significant insurance benefits. Homeowners should also consider comprehensive home inspection services, including wind mitigation inspections, to ensure their homes meet insurance standards and discounts. The Wind Mitigation Inspection cost, for example, can be a worthwhile investment, potentially saving Florida homeowners on their insurance premiums through the 5 year life of the Wind Mitigation form.

As we’ve explored the why and how insurance cares about your HVAC system, it’s clear that taking proactive steps in maintaining and upgrading your system can lead to substantial benefits, both in terms of home safety and insurance costs. We encourage homeowners to review their current HVAC systems and consider updates or maintenance that could lead to better insurance rates and a safer, more comfortable home environment.